In the rapidly evolving world of online trading platforms, the question of legality is crucial for traders and investors. One such platform that has gained significant popularity is Pocket Option. As more individuals turn to online trading to capitalize on market opportunities, understanding the Pocket Option Legality легальность Pocket Option becomes essential. In this article, we will delve into the legal landscape surrounding Pocket Option, analyzing its regulatory compliance, licensing, and the implications for traders looking to engage with this platform.

The emergence of online trading has fostered an expansive market, but it has also prompted regulatory bodies worldwide to scrutinize these platforms closely. Regulations typically aim to protect traders, prevent fraud, ensure transparency, and maintain fair market practices. Each country has different regulations, and these can significantly impact how trading platforms operate.

Pocket Option is operated by Gembell Limited, a company that holds a license from the International Financial Market Relations Regulation Center (IFMRRC). This license is crucial as it indicates that the platform meets certain regulatory standards. However, it is important to note that the IFMRRC does not provide the same level of oversight or consumer protection as regulators like the FCA in the UK or the SEC in the USA.

Traders should evaluate the implications of these licensing conditions. While Pocket Option’s license demonstrates an effort to operate within a regulatory framework, the extent of protection afforded to traders is not as robust as it could be with more stringent regulatory bodies.

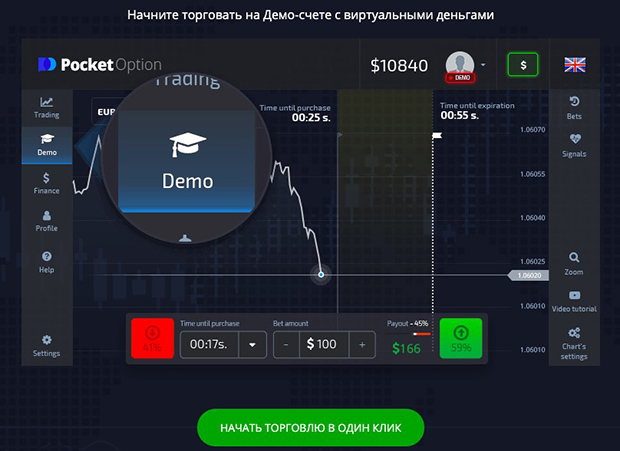

The Pocket Option platform enables traders to engage with various financial instruments, including forex, cryptocurrencies, stocks, and commodities. One of the appealing features is the availability of demo accounts, which allow new traders to practice trading strategies without financial risk. Yet, the platform’s operations are subject to local regulations, and traders should be aware that certain activities may be restricted depending on their jurisdiction.

For example, U.S. residents are typically not permitted to trade with many offshore platforms due to regulatory restrictions, which further emphasizes the importance of understanding the legal context of using platforms like Pocket Option.

Pocket Option complies with the laws of the jurisdictions in which it operates, which can sometimes create confusion for traders. For instance, while Pocket Option may be fully compliant in one country, it might face different legal hurdles in another. Therefore, it’s essential for traders to understand their local regulations before committing to trading on such platforms. For instance, in the EU, strict regulations apply to financial trading, while in some Asia-Pacific countries, regulations may be less stringent.

Trading with a platform like Pocket Option comes with inherent risks. The lack of regulation from a major authority can lead to reduced consumer protection and may expose traders to potential fraud or malpractice. Additionally, the volatility of financial markets means that investors could face significant losses, and having a reliable regulatory body overseeing the platform would provide additional security.

Moreover, traders should be cautious about the terms of service and withdrawal policies. It’s essential to read these documents carefully, as they outline the conditions under which withdrawals can be made and any associated fees. Some users have reported challenges with withdrawing funds, which can be a significant concern for those investing substantial amounts.

For traders operating internationally, the legality of using Pocket Option can differ markedly. Some countries may have specific prohibitions against online trading or may classify such activities differently. A trader’s country of residence can dramatically influence their legal standing when using a platform like Pocket Option, so performing diligent research is foundational to safeguarding your investments.

Additionally, cryptocurrency trading, which is a focus of Pocket Option, carries its own set of regulatory challenges. Countries like China have banned cryptocurrency trading, while others embrace it. For traders, this variability underlines the importance of staying abreast of local regulations and any potential changes that may arise.

Ultimately, the legality of Pocket Option significantly hinges on individual circumstances, including the user’s location and the regulations governing online trading in that region. While the platform has gained a considerable following due to its user-friendly interface and diverse trading options, traders must conduct thorough due diligence to evaluate its legality fully.

Understanding the associated risks, including potential regulatory issues and withdrawal difficulties, is essential before investing. As the trading environment continues to evolve, staying informed about legal requirements will empower traders to make better investment decisions and navigate the complexities of the financial markets safely.